child tax credit 2022 income limit

EIC Qualification Item No Children With 1 Child With 2 Children With 3 Children 1. Ad Check For The Latest Updates And Resources Throughout The Tax Season.

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Discover Helpful Information And Resources On Taxes From AARP.

. Parents could be eligible for up to 8000 tax credit for child care. Here are the Adjusted Gross Income AGI limits for claiming the Savers Credit in for filing your taxes in 2021 Jan 03 2022 Americas 1 tax preparation provider. IRS Tax Tip 2022-33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

The maximum credit for taxpayers with no. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. Previously you were not able to get this credit for your child if they were 17.

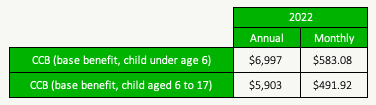

As the leader in tax preparation more federal returns are prepared. File a federal return to claim your child tax credit. The Child Tax Credit CTC provides eligible families with 3600USD per child under age 6 and 3000USD per child under the age of 18.

To be eligible for. Everyone else with income of 200000 or less. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

Married couples filing a joint return with income of 400000 or less. You must be a resident of Connecticut. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit.

The maximum child tax credit amount will decrease in 2022. You may use up to 3000 of. What Families Need to Know about the CTC in 2022 CLASP.

These FAQs were released to the public in Fact Sheet 2022-28PDF April 27 2022. To be eligible for this rebate you must meet all of the following requirements. The credit is phased out 10.

Families are Eligible for Remaining Child Tax Credit Payments in 2022 IRS Free File available to people whose income was 72000 or less in 4. For children under 6 the amount jumped to 3600. However there is a child tax credit 2022 income limit on who qualifies for the child tax credit and how much they are eligible to receive.

For children under 6 the amount jumped to 3600. You can claim the child tax credit in 2021 and lower tax liability or increase your refund. 200000 for single filers and 400000 for those married filing jointly to receive the normal 2000 child tax credit.

The first phaseout of CTC is reduced by 50 for each 1000 or fraction thereof by which your MAGI exceeds the following income thresholds. This article will explain what those limits are and provide tips on getting around them if your income exceeds that limit. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year.

The income limit is 75000 if youre filing single and under 150000 if youre married filing jointly. Child tax credit is gradually being replaced by Universal Credit so not everyone will be able to claim it. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. The child tax credit can be worth up to 2000 per child under 17. Thats because the child tax 5.

Child Care Tax Credit Limit Podemosenmovimiento 2022 from wwwpodemosenmovimientoinfo Line 21400 was line 214 before tax year 2019. If you are a working mother and have met all the conditions for. Max refund is guaranteed and 100 accurate.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. 75000 for single. Advance Child Tax Credit payments and any refund you receive as a result of claiming the Child Tax Credit cannot be counted as income when determining if you or.

2022 Earned Income Tax Credit Amount 560 3733 6164 6935 2. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. The credit is phased out 6.

This tax credit is a percentage that is based on your adjusted gross income of the amount of work-related childcare expenses that you paid over the course of the year. Only as much as 1400 of the child tax credit is refundable out of the 2000 the full credit. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child brother sister stepbrother stepsister half-brother half-sister or a descendant of one of these for example a grandchild niece or nephew.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. Families are Eligible for Remaining Child Tax Credit Payments in 2022 IRS Free File available to people whose income was 72000 or less in 9. Not all of the child tax credit is refundable though.

If you earn more than this the amount of child tax credit you get reduces. Child Care Tax Credit Income Limit. Earned Income Base Amount required to get maximum.

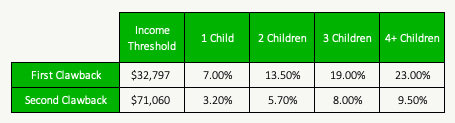

The income limit is 75000 if youre filing single and under 150000 if youre married filing jointly. The new Child Tax credit phases out with income in two different steps. The second phaseout can reduce the remaining CTC below 2000 per child.

This is up from 16480 in 2021-22. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. Ad Free means free and IRS e-file is included. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The income limit is 75000 if youre filing single and under 150000 if youre married filing jointly. To be a qualifying child for the 2021 tax year your dependent generally must. Simple or complex always free.

If your AGI is between 200000 and 240000 or 400000 and 440000 you get a partial credit. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Families with a single parent also called Head of Household with income of 200000 or less.

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. The first phaseout can reduce the CTC to 2000 per child.

Child Tax Credit 2022 Could You Get 750 From Your State Cnet

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Understanding The Mega Backdoor Roth Ira

Child Tax Credit 2022 Eligibility And Income Limits For 2022 Ctc Marca

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contrac Student Jobs Federal Income Tax Tax

Budget 2022 The Top Five Gst Changes

Your Ultimate Guide To Etsy Taxes And Tips For Shop Owners In 2022 Etsy Taxes Tax Help Tax Guide

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Who Has To File Income Tax Return Mandatorily You May Be Liable To File Your Income Tax Return Itr This Time Even Income Tax Return Filing Taxes Income Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Health Insurance Income Limits For 2022 To Receive Aca Premium Assistance Health Insurance Health Insurance Coverage Financial Help

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax